Today sees the release of March data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – signalled further marked increases in output and new orders, although growth rates eased from February. Meanwhile, near-record increases in input costs and output prices were recorded, with the impact of stronger inflation leading to a sharp drop in confidence.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“The NI private sector continued to show signs of growth in output, employment and order books in March, but there is no disguising the impact that the Ukraine / Russian conflict has had on business conditions. This has manifested itself in three key areas – escalating inflation, a slowdown in incoming business, and a significant dent to business confidence.

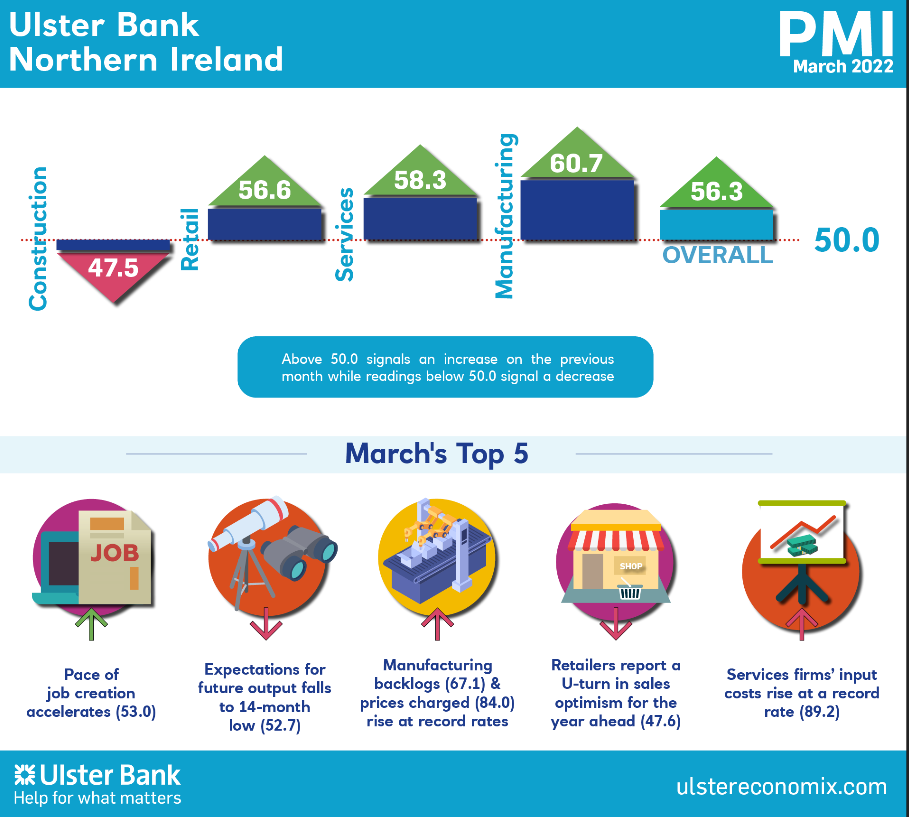

“Looking at the performance of the various sectors in March, construction was the one area to experience a fall in output. Meanwhile retail and services activity accelerated, and the rate of manufacturing output growth eased back, but remains strong. However, it is in firms’ order books that the challenges of the current environment are evident. All sectors saw the pace of new orders growth slow or fall. In the case of construction, this was the ninth successive month of order book contraction.

“Unsurprisingly, the latest PMI shows very clearly the inflationary pressures facing Northern Ireland companies. We have heard so much about the cost of living crisis, but the cost of doing business crisis is also affecting local firms in spades. In the services sector, wage and energy cost pressures pushed input costs to record highs. In manufacturing, firms are raising their prices at a record rate to cope with the cost pressures they are experiencing. And across the board in the private sector, inflationary pressures are moving back towards last year’s all-time highs.

“With these inflationary pressures, combined with supply chain disruption and ongoing skills shortages, private sector firms reported a big fall in confidence regarding the year ahead. They still anticipate that output will rise in the next 12 months on balance, however their expectations have been scaled back. Manufacturing is still the most optimistic sector, followed by services. But construction firms expect no growth over the next year and retailers anticipate a fall in output. With consumers’ finances now under so much pressure from, for instance, the doubling in the price of home heating oil in the space of two weeks, retailer sentiment has in effect done a 180 degree turn in the space of a month. It has gone from expecting strong growth to now expecting a marked decline.

“The key drivers of the falling confidence – inflationary pressures and supply chain disruption – are not going away. Indeed with tax rises coming into effect in April, pressures on businesses and their customers will intensify.”